Office Market Still Holding Steady

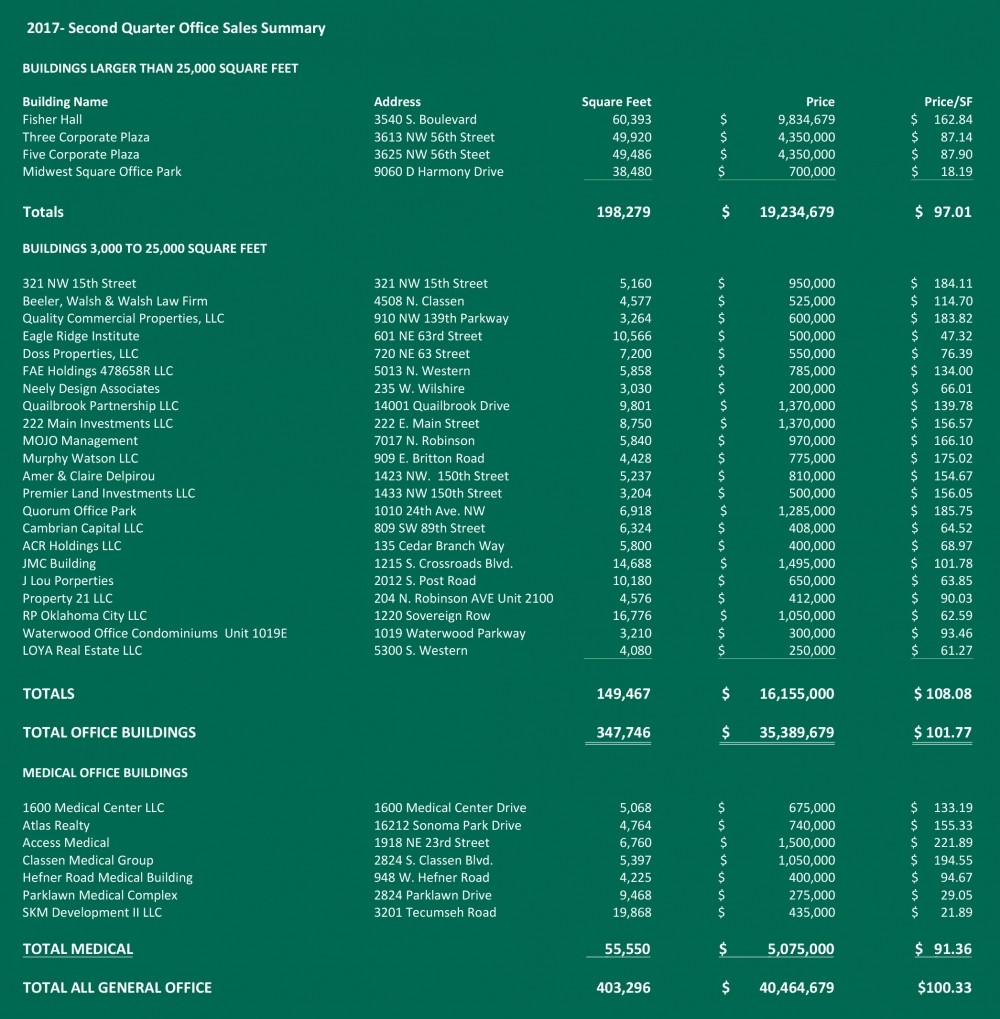

The second quarter of 2017 has shown remarkable resilience in the Oklahoma City office sales market. The anticipated downturn in sales has not yet hit the marketplace. We know vacancies in the office market have risen, which would normally lead to a slump in sales but that has not occurred, at least not yet. The numbers are a bit skewed due to the low per square foot sales price on one property but with that exception, the market remains solid.

The second quarter saw four sales of buildings in excess of 25,000 square feet. The total square footage was 198,279 and the total sales price was $19,234,679, which was an average of $97.01 per square foot. The high sale was $162.84 per square foot and the low was $18.19 per square foot. The other two sales were in the mid $80 per square foot range.We saw robust sales of buildings in the 3,000 to 25,000 square foot range. Twenty-six buildings changed hands in the quarter. The total square footage was 149,467 square feet with a total price of $16,155,000 or $108.08 per square foot on average.

Medical offices saw total sales of seven buildings containing a total of 55,550 square feet at $5,075,000 or $91.36 per square foot.

As office sales continue throughout the year, it will be interesting to see if the new normal for oil prices has any effect on sales. Large blocks of office space are for lease, but it seems to have little effect on the market for investments in larger buildings with solid rent rolls and in good physical condition.

Office Division

Cordell Brown, CCIM, CIPS

Office Investment Specialist

Retail Division

Paul Ravencraft, George Williams, Phillip Mazaheri, CCIM

Retail Investment Specialists

OKC Outlets Sold in 2nd Quarter

Retail investment sales were quiet in the second quarter with one big exception, The Outlet Resource Group's $128.6 million purchase of the Outlet Shoppes of Oklahoma City. Re-branded OKC Outlets, the property is a specialty use property that is the only outlet mall in Oklahoma City. TORG plans to make some improvements to the mall and continue to tweak the tenant mix. The only other sale of a greater than 25,000 square foot property in the quarter was the 31,200 square foot, Willow Creek. Otherwise, the uncertainty that characterizes the broader retail economy appears to have also affected investment sales. There remain significantly more buyers in the market than sellers. As part of a countrywide trend, one group of buyers, the larger institutional real estate firms, have not bid on the last couple of institutional grade properties in our market, resulting in an at least 100 basis point increase in capitalization rates for class A properties. This trend may open the door for more local and regional investors to buy up in quality. Expect the current turbulence retailers are experiencing to create opportunities for these retail investors.

Industrial Division

Danny Rivera, Mark Patton, Bob Puckett, Chris Roberts

Industrial Investment Specialists

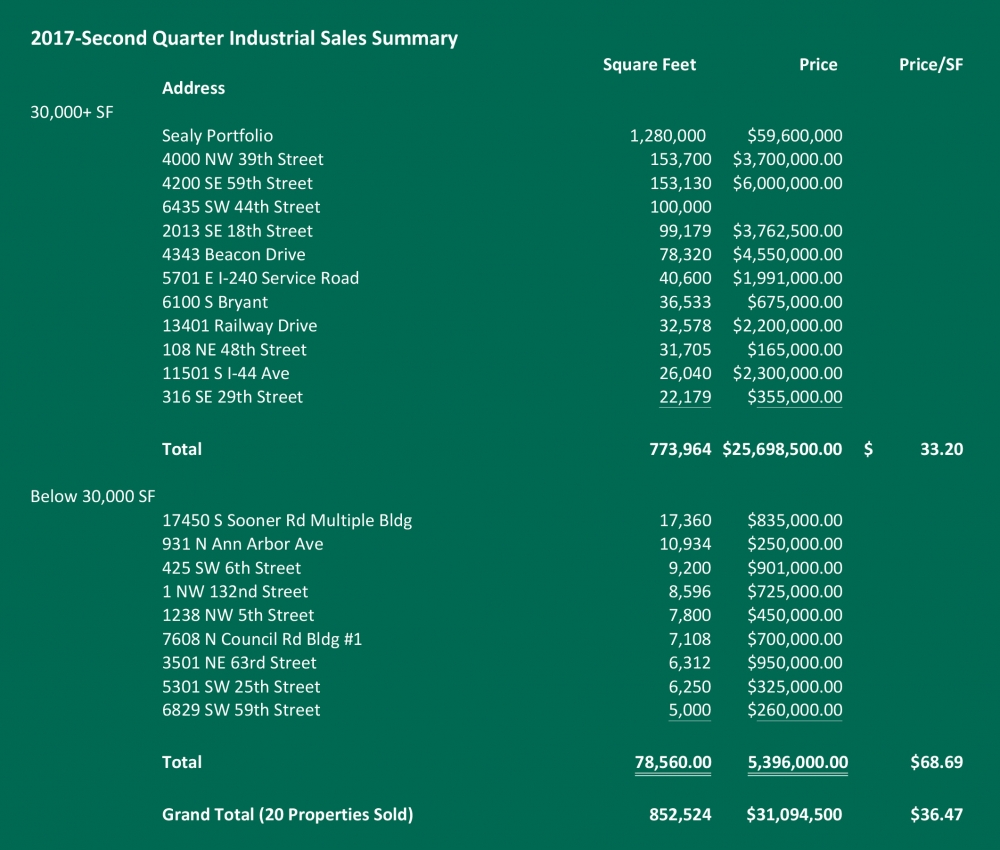

Industrial Market Continues to Flourish

The Second Quarter of 2017 continues to show activity in the industrial market as compared with the 1st quarter of 2017. Overall there were 20 industrial buildings sold containing 852,524 square feet. The market-wide average price per square foot in the 2nd quarter was $68.69. With the number of transactions decreasing slightly from the 1st quarter of 2017, the overall dollar volume was increased to $31 million versus $22.7 million.

The current economy seems to be recovering with still some hesitation, but the increase of dollar volume reflects a positive outlook. The overall industrial vacancy has edged up to 7.5% from the previous quarter of 6.8% but still represents a very high occupancy market dynamic. In a market the size of Oklahoma City, a low vacancy rate translates to a competitive market for all parties involved. Also, during the second quarter, there was a large portfolio sale of 1.7 million SF for $59,600,000 which is not reflected in this report.

Multifamily Division

David Dirkschneider

Multifamily Investment Specialist

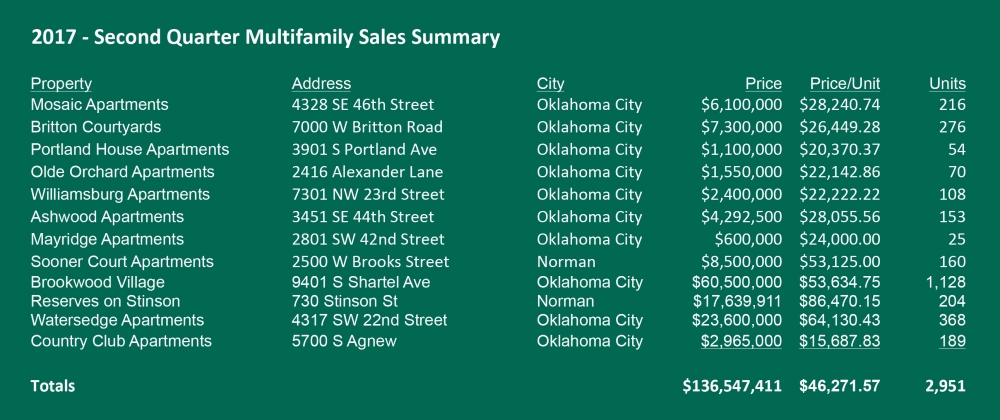

Multifamily Market Experiencing Second Quarter Sale Surge

In the second quarter of 2017, the Oklahoma City multifamily market was injected with a shot of adrenaline surpassing any previous quarters total sales volume since the 4th quarter of 2015, and surpassing any mid-year sales volume since 2012. The big question on everyone’s mind is how long will this last, and how much construction can we continue to handle. The job market continues to improve with unemployment in Oklahoma City reaching as low as 3.5 percent in April, but slightly up from 4.1 percent at the end of June; however, still down from 4.3 the same period last year. Although it’s not the job market that’s continuing to press new construction forward, otherwise there would have been a break when unemployment peaked in 2016. The current construction boom is being fueled by the cheap cost of money and the availability of still fairly easy financing. This construction boom seems to be more of a plateau than a peak with the past three years all almost double the ten-year trailing. However, according to a joint report released by NMHC and NAA titled “Vision 2030”, construction pace could continue at the current pace and would still fall moderately short of the demand by 2030. This raises the question of where will all these renters come from because in Oklahoma City new properties are experiencing slow lease-ups and must offer more concessions than they initially projected. The urban core assets have struggled the most along with a few other pocket areas with a high concentration of new construction, while the rest of the market remains healthy and even has experienced some increase in average rents due to the high cost of the units.

The second quarter saw 12 multifamily transactions, involving twenty-five units or more, with a total of 2,951 units. This level of volume is an astounding 220 percent higher than the same quarter last year and 211 percent higher than the previous quarter this year. Year-to-date, the total transaction volume is just over $180 million, 81 percent higher than the previous year. Although the volume has increased significantly, the average price per unit is flat, with less than one percent change from the previous year. Total transactions were up 60 percent from the previous year at 24 mid-way through 2017, and total units sold spiked to over 4,200. Compared to the previous year, the Class A, B and D transactions remained flat with both only having one transaction, with the biggest change in C Class assets. So far in 2017, Oklahoma City has had a total of $139 million in transaction volume for Class C assets alone; an astounding 157 percent increase over the same time period the previous year. With an increase in total units sold of 122 percent, this shows investors are paying more for Class C assets than they were a year ago. The average price paid for Class C properties halfway through the year is $39,508 overall or $40,860 for performing properties. It should be noted that in 2017 there was a higher number of transactions involving fully renovated Class C properties, which was a large factor in the average price increase. If you removed fully renovated properties, the average price per unit remains flat from the previous year at $32,376 per unit and the fully renovated Class C assets averaged just over $53,000 per unit.

As previously stated, new deliveries continue to happen despite the knowledge of slow absorption. 2016 added 3,407 new units, and 2017 is on track to add another 2,200. One issue that will need to be addressed is the lack of affordable housing because only approximately 7 percent of the new units being delivered are considered affordable, while the remaining 93 percent are Class A or even luxury. This disparity in rent costs compared to the amount the average person can afford is growing further and further and is likely one of the biggest reasons for the slow lease-up felt at most of the new properties. To sufficiently meet the demand addressed in the Vision 2030 report, there will need to be a mixture of units that are available to all income levels, and currently, the luxury market is dominating the new completions. As long as financing sources are readily available, and barring any major negative economic events, this construction pace is likely to continue another year or two.

2017 continues to impress and surprise even the most experienced multifamily professionals with the aggressive pace of transaction activity. How long this will continue is unknown, but what does appear most likely is that 2017 will continue to see activity and, with a lack of inventory readily available, prices are likely to increase. Sellers who have sat on the sideline waiting for the top of the market should strongly consider jumping in.

For more detailed information on the rental market please see Price Edwards & Company’s 2016 Year End Multifamily Survey.