Office Market Slows in First Quarter of 2018

Cordell Brown, CCIM, CIPS, Office Investment Specialists

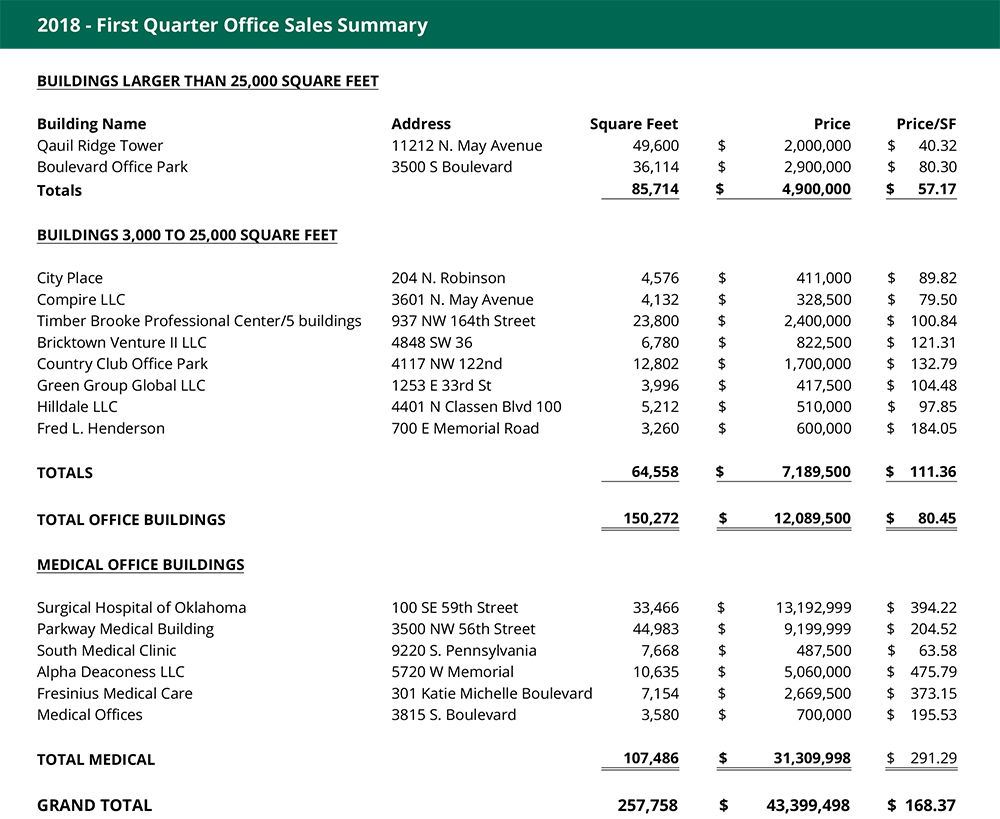

The 1st Quarter of 2018 is showing the results of a tough year of leasing in 2017 and is indicative of a slowdown now occurring in the office sales market. Higher vacancy rates eventually affect capitalization rates and projected returns on investment. This puts pressure on sales prices and causes sellers to have second thoughts about going to the market with investment properties. Only two office sales in excess of 25,000 square feet were recorded in the 1st Quarter of 2018 and both were Class C buildings in the Northwest and Edmond Submarkets. Those buildings, totaling 85,714 square feet sold for $4,900,000 or $57.17 per square foot.

In the smaller office building market consisting of 3,000 square feet to 25,000 square feet, there were eight sales. All of the sales with one exception were in the suburban markets. The exception being recorded in the Central Business District. The eight sales (one consisted of five smaller buildings in an office park) totaled 64,550 square feet selling for $7,189,500 or $111.36 per square foot.

If there was a shining star for the 1st Quarter, it was in the medical building arena. Five buildings totaling 107,486 square feet sold for a total of $31,309,998 or $291.29 per square foot. The largest two of those sales, making up over 78,000 square feet were sales to investors.

Conversations with local investors and owners still indicate a positive attitude about the office market. At the same time, investors are eyeing the market for underperforming opportunities that may have future upside. Positive attitudes and events in the OKC market have helped buoy the anticipation of great things to come.

Please note that due to a transition to an upgraded format in the Oklahoma County Assessor’s website and the exit of Xcelligent from the real estate market, not all sales may have been reported.

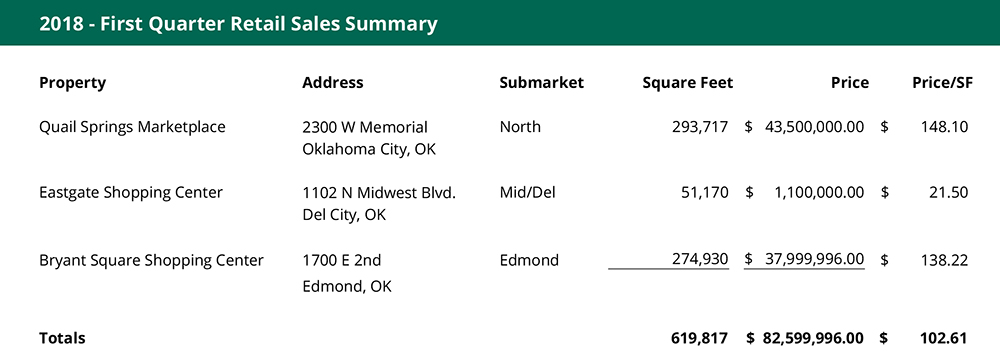

Institutional Investors Continue to Divest of Oklahoma Retail

Paul Ravencraft, George Williams, CCIM, Phillip Mazaheri, CCIM, Retail Investment Specialists

Five years ago, most of Oklahoma's premium retail properties were in the hands of national institutional investors. Most have since sold their Oklahoma holdings, a trend that continued in the first quarter of 2018 with the sale of Quail Springs Marketplace and Bryant Square Shopping Center by JP Morgan and Inventrust, respectively. Many were originally drawn to this market because they could buy-in at a higher capitalization rate than their traditional markets and therefore generate higher returns. Their exodus has been driven by a number of factors. In some cases, the lifecycle of the investment necessitated a return of funds to investors. Others did not see the higher returns initially envisioned. But, the greater influence was no doubt the disruption in the national retail market and a desire by institutions to exit secondary markets and return to their core markets.

When institutions make the decision to leave, they tend to do so at current market values regardless of their investment basis. In the case of these two recent sales, Quail Springs Marketplace sold for less than JP Morgan paid for it in 2005; and, Bryant Square sold for less than Inventrust has spent buying and upgrading the center. During this time period, capitalization rates on class A centers have been rising, partially due to the lack of institutional investors, partially due to the uncertainty in the retail market, and, more recently, due to the rise in interest rates. Institutional investors will come back when retail stabilizes, but for now, prices have come down and opened the door for more local and regional buyers.

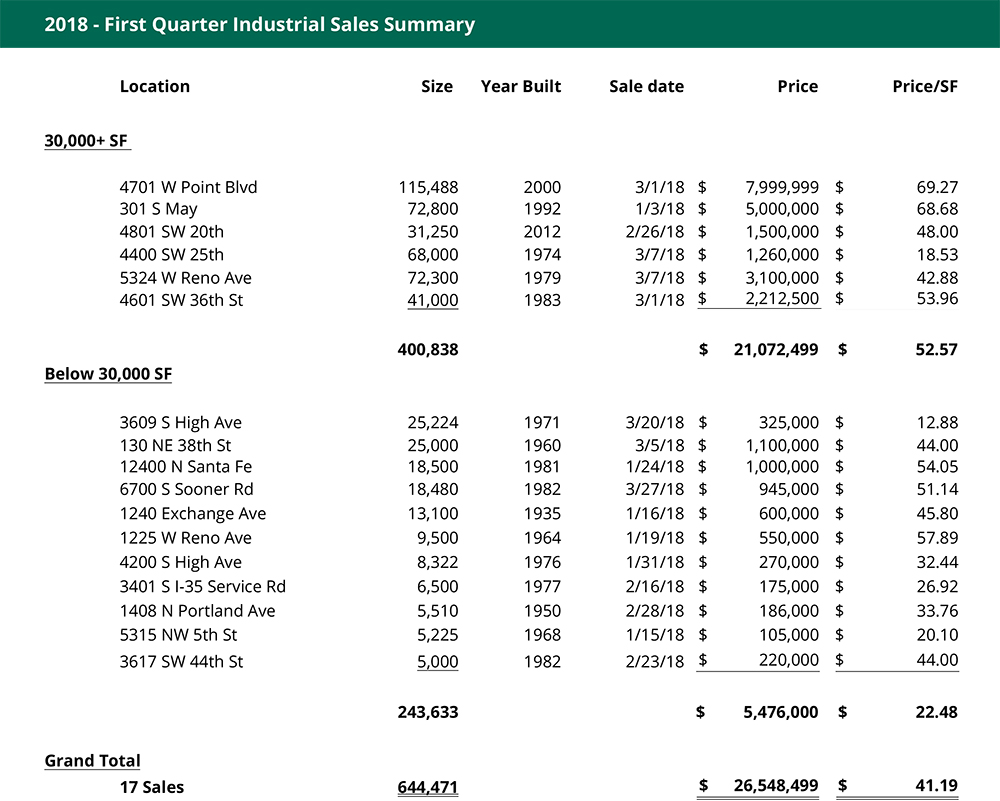

Industrial Market Outpaces 2017 Opening Quarter

Danny Rivera, Mark Patton, Bob Puckett, Chris Roberts, Industrial Investment Specialists

The First Quarter of 2018 is above par for the industrial market as compared with the 1st quarter of 2017. Overall there were 17 industrial transactions containing 644,471 square feet. The market-wide average price per square foot in the 1st quarter was $41.19. Seventeen sales transactions generated $26,548,499 of total dollar volume.

The industrial vacancy continues to hover around 4.1% from the previous quarter. It is a reflection of a steady market dynamic which has stabilized, what can be a highly volatile industrial market with an ever-present correlation between Oklahoma City’s economy and the state's oil and gas production.

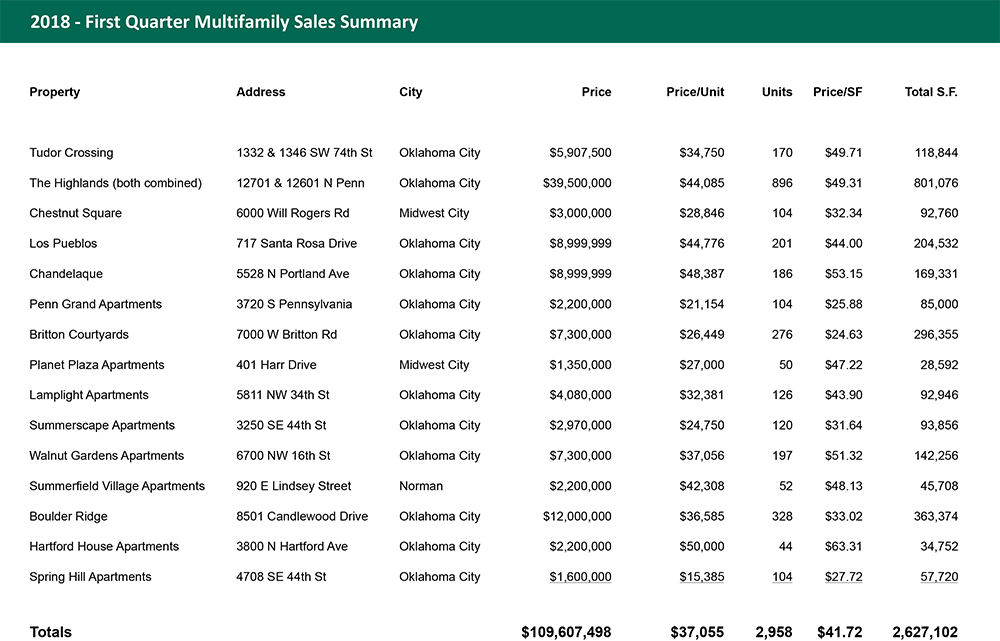

Multifamily Market Sees Surge to Start 2018

David Dirkschneider, Michael Massad Multifamily Investment Specialists

In the first quarter of 2018, the Oklahoma City multifamily market continued its strong pace with robust sales volume surging 149% higher than the previous years first quarter. This is spurred by the local economy continuing to outperform the national economy, keeping unemployment low at only 3.6%, well below the national average for much of the recovery. If 2018 stayed on the same pace for every quarter, it would make 2018 the highest sales volume year in Oklahoma history. In the first quarter of 2018, Oklahoma City had 2,958 units transact totaling just over $109 million in volume. This equals $36,992 per unit, 9% over the same time period last year. Compared to the previous quarter, the price per unit was down 58%; however, in the first quarter of 2018 all transactions were Class C or distressed properties, and the previous quarter had various asset classes that had traded. Although this is a very strong start to the year, there are several factors signaling this pace isn’t likely to continue. First and foremost, there is no shortage of buyers looking in today’s market, but there is definitely a shortage of properties that investors are able to acquire. At 105 months into the expansion phase, we are starting to see prolonged rising in interest rates, which has already caused some volatility in the market as buyers and seller start to look at the long-term effect on mortgage rates. Where will rates be when their current loans are due, or where will they be when their next capital event occurs; these are the questions starting to concern multifamily owners. While rising interest rates will ultimately cause a negative impact on property values, it will also likely have a positive impact on leasing demand. A report from CoStar cites that for every rise in home mortgage interest rates, thousands of renters will have to delay buying – thereby significantly increasing the pool of renters and bolstering multifamily fundamentals.

Oklahoma City multifamily properties have continued to operate on solid ground and the overall vacancy rate is expected to slowly decrease as demand continues to increase and fewer new units are added to the inventory. Projected annual rent growth continues to be along the lines of historical averages, around or slightly above 3% annually. The potential slowdown in homebuying could cause an increased demand that could push rent growth slightly higher than historical averages but will most likely stay below 4%. Overall, the Oklahoma economy will continue to outperform many other states and unemployment will remain lower than most major metropolitan areas. Although there have been recent concerns with layoffs in the energy industry, and the impact it will have on housing, the fact remains that the energy industry only makes up 3.3 percent of our metro employment. Although there is no question that Oklahoma is an energy dominate state, we have proven through several years of low energy prices that we are now more diversified than ever with increased employment activity in the aerospace, bioscience and healthcare industries.

Going forward, we are optimistic over the next six to twelve months that the market will remain healthy; however, there is concern some ill-advised lending practices are being repeated from previous real estate cycles. One can’t help but notice the amount of interest only loans, higher than normal LTV balances on new purchases, and generally high purchase prices paid for inferior assets. In the past year prices have been paid on actual numbers over projected; however, it does appear that dynamic is starting to shift slightly. Multifamily investors need to have a clear understanding of the quality of revenue streams they are purchasing, make sure to underwrite realistic rental increases, and have adequate capital reserves for a rainy day. They always come.