Office

Cordell Brown

CCIM, CIPS

Office Investment Specialist

First Quarter Active With Local Buyers

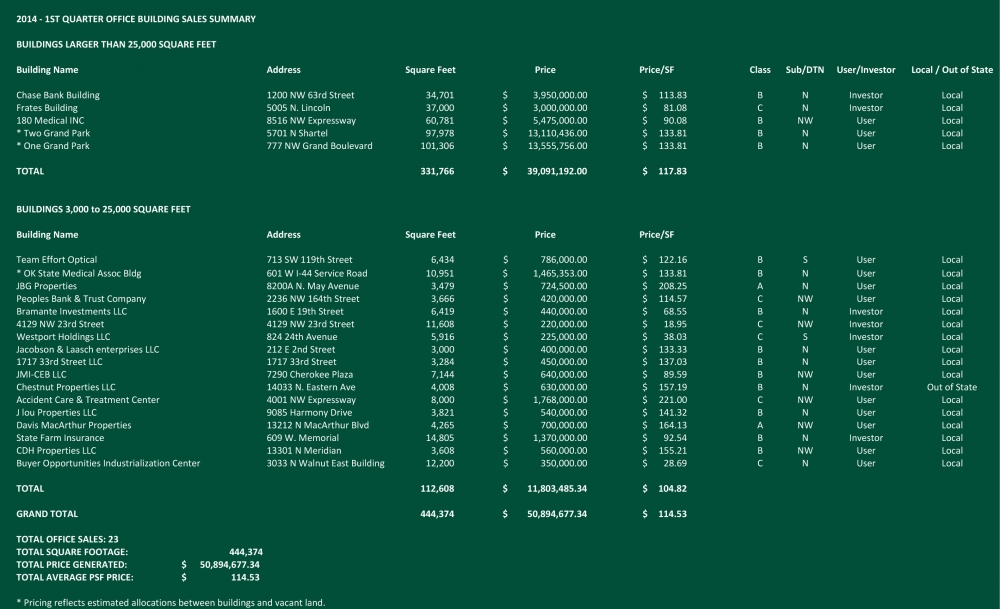

The 1st Quarter of 2014 proved to be very active in the Oklahoma City office market. Local investors and users continue to step up to purchase office buildings, showing an appetite for both large and small properties. Of the twenty two sales recorded for this report, all but one went to local buyers. Five of the buildings sold were in excess of 25,000 square feet. The five buildings totaled 331,766 square feet at a total of $39,091,192 or $117.83 per square foot. The most significant transaction of the quarter was the sale of assets by Chesapeake Land Company to MidFirst Bank, all of which are just west of the MidFirst Headquarters building at 501 NW Grand Boulevard. MidFirst now owns roughly 400,000 square feet of office space in the immediate area.

In the category of buildings below 25,000 square feet, there were 17 sales. This is a strong indicator of the ongoing trend by many small companies to own rather than lease space. The average price per square foot of all buildings continues its upward trend with the buildings coming in at an average sale price of $114.53 per square foot.

As Oklahoma City continues its trend as one the fastest growing cities in the nation and an unemployment rate hovering at just 5%, the office market should see continued demand for both large and small buildings.

Retail

Phillip Mazaheri and Paul Ravencraft

Retail Investment Specialists

First Quarter of 2014 Sees Largest Quarterly Sales Volume Since 2007

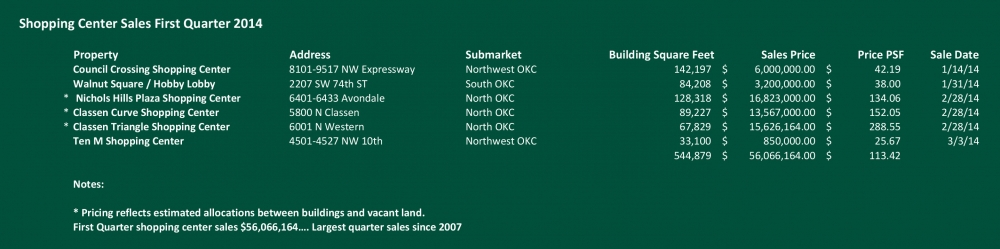

Driven by the sale of the three Chesapeake owned retail centers – Nichols Hills Plaza, Classen Curve, and Classen Triangle – first quarter sales totaled $56.1 million which represented the largest quarterly sales volume since 2007. While the sale continues Chesapeake’s divestiture of non-core holdings, it could very well be an important move for Oklahoma City retail given the buyer, Glimcher Properties. Glimcher is highly regarded nationally as a developer; consequently, the combined project could become something special, particularly since it included the land between Nichols Hills Plaza and Classen Triangle.

The owners of Walnut Square purchased the building occupied by Hobby Lobby & Uptown Thrift, in essence, adding it back to Walnut Square Shopping Center. The two remaining sales, Ten M & Council Crossing, both had significant vacancy and sold at a discount. The trend continues of properties on the opposite ends of the market selling with limited middle market product trading hands. There remain significantly more buyers than sellers which has pushed capitalization rates down, especially for upper end product.

Industrial

Mark Patton and Bob Puckett

Industrial Specialists

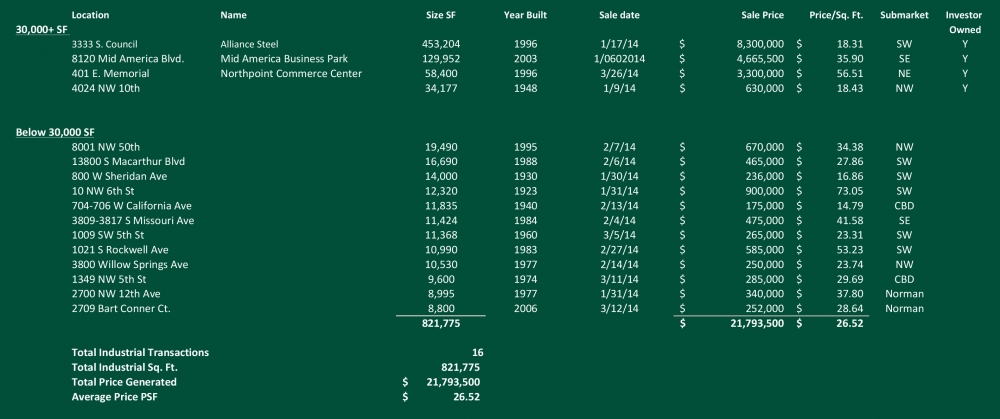

Over 800,000 Square Feet Sold in First Quarter

First quarter 2014 continues the general trend of large investment sales, small owner-user sales, and very little activity in mid-range sizes. Four investment sales took place including the sale-leaseback of the 453,000 square foot Alliance Steel facility. Also, the third and final industrial building at Mid America Business Park sold, transferring all three industrial facilities in the park to a local investment group. Along with this, Northpoint Commerce Center at 401 E. Memorial, sold to a tenant in the building. The total square footage sold was 821,775 square feet as opposed to 247,947 square feet in the first quarter of 2013. The average building size transacted this quarter was 51,360 square feet, a number skewed by the large investment sale. The total consideration this quarter was $21.8 million, and the average price per square foot was $26.52, also influenced by the large sale. Without the single large sale the average price per square foot of $36.61 more accurately reflects current market values.

Multifamily

David Dirkschneider

Multifamily Specialist

Multifamily Market Off to a Good Start for 2014

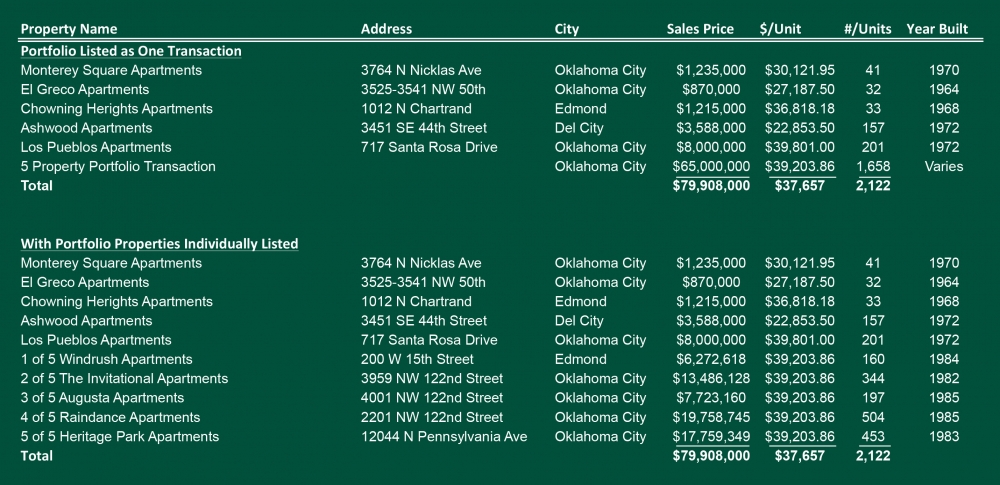

The first quarter of 2014 got off to a very solid start, with one large multi-property sale involving 5 assets and a handful of smaller transactions. Quarterly sales volume totaled $79.9 million involving 2,122 units, which equates to pricing of $37,656 per unit. Price per unit is an unreliable indicator in that it varies widely based on the class, age and size of the properties involved.

The off-market portfolio sale has left some local brokers and investors scratching their heads. The properties involved are generally considered to be Class B assets, and the price per unit of just over $39,000 seems very low, lower even that some sales involving Class C properties. A publicly traded REIT purchased these units, so there may be more information provided at some point.

It should be noted that Class C properties continue to attract investor interest with values continuing to be pushed up; first quarter Class C assets sold for just under $35,000 per unit. In the last 15 months there have been over 3,000 Class C units changing hands, with an average price of just over $25,000 per unit. This figure includes distressed assets, which after backing those out, the average price increases to over $29,000 per unit. It is expected that rents at well managed and properly renovated Class C projects will continue to increase, thus rewarding investors with attractive risk adjusted returns.

While there is some concern about the number of Class A units coming on the market, all indications are that pro forma rents are being achieved. Class B owners continue to be a market segment with very few sellers as they perceive an ability to increase rents in the coming year as the Class A units hit the market.