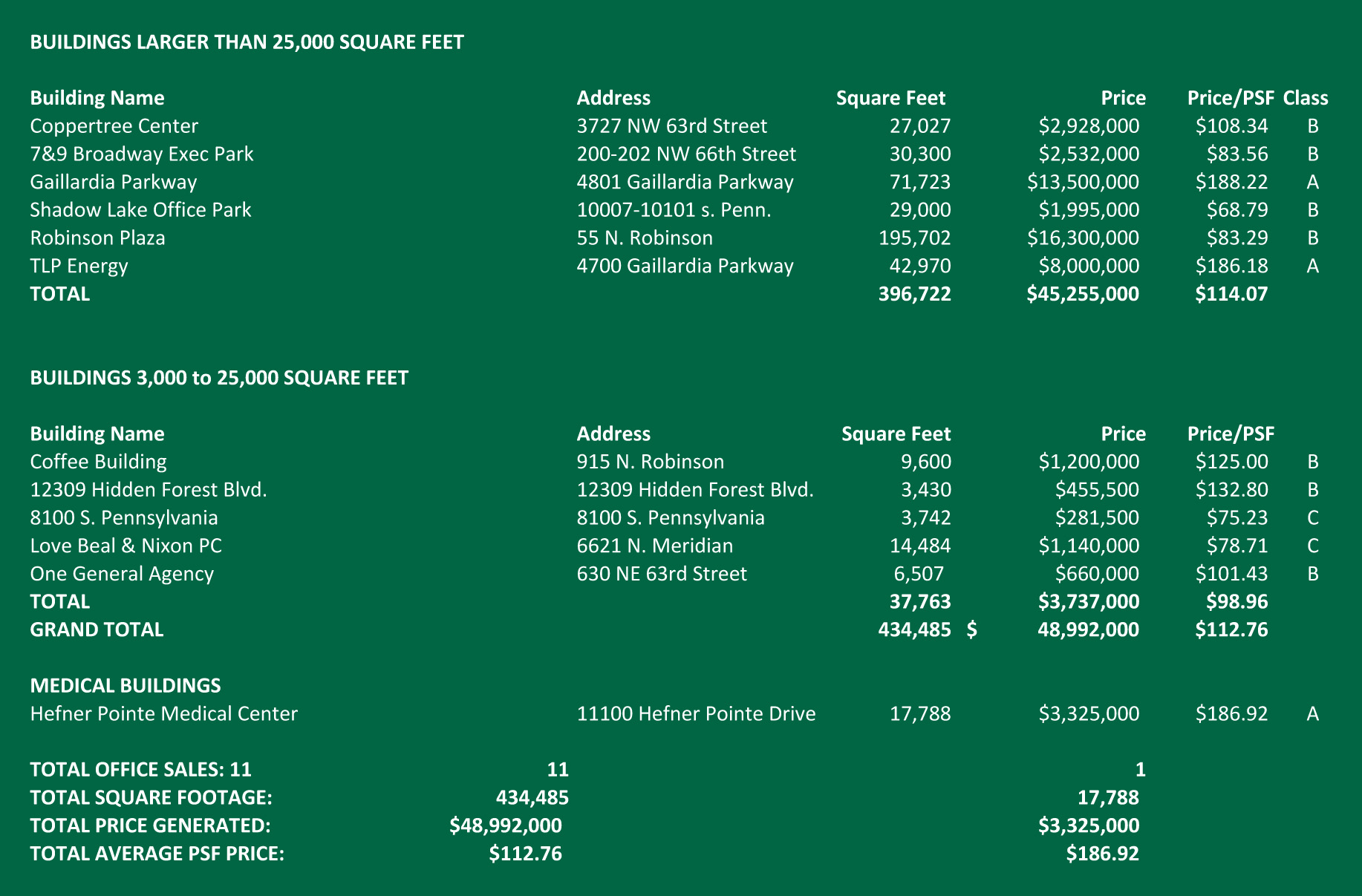

Office Office Sales Exceed $48,000,000

The first Quarter of 2013 saw brisk office building sales activity.

A total of 11 properties, ranging in size from 3,430 square feet to 195,702 square feet, changed hands.

Total square footage was 434,485 and total dollar volume was $48,992,000, which equated to an average price of $112.76 per square foot.

This compares with 16 general office sales in the 1st Quarter of 2012, which comprised a total of 334,794 square feet at an average price per square foot of $85.21 on total volume of $28,527,500.

One medical office building sold in the first quarter of 2013, which is considered a separate asset class from general office.

That almost 18,000 square foot property sold for $3,325,000, just under $187.00 per square foot to user Chesapeake Energy is expected to continue shedding certain office properties in the next quarter.

Atrium Towers at 63rd and Lake Hefner Parkway and the adjacent former IBC Bank building are reportedly under contract to sell to another locally headquartered company.

That transaction, comprising over 200,000 square feet of space, is reported to be in the range of $20,000,000 to $25,000,000.

Central Park I & II, containing approximately 237,000 square feet at Interstate 44 and Lincoln, is reportedly under contract to an out of state investor for a similar amount. It is unclear whether other larger corporately owned office assets might be sold in the coming years.

The only other notable property which made the news is Lincoln Plaza which has been placed into foreclosure.

It remains unclear whether the lender will opt for a quick liquidation, or invest capital dollars to bring the property up to a more leasable condition.

Overall, users and investors for office properties appear to be fairly abundant at this time.

Very few properties remain on the market for long periods of time.

The exceptions are those not suited for easy renovation, are lower quality or have poor locations.

Class “A” and “B” properties tend to move quickly, regardless of occupancy.

As such, it appears the Oklahoma City Office Market will continue its strong performance for the remainder of 2013.

Cordell Brown

CCIM, CIPS

Office Investment Specialist

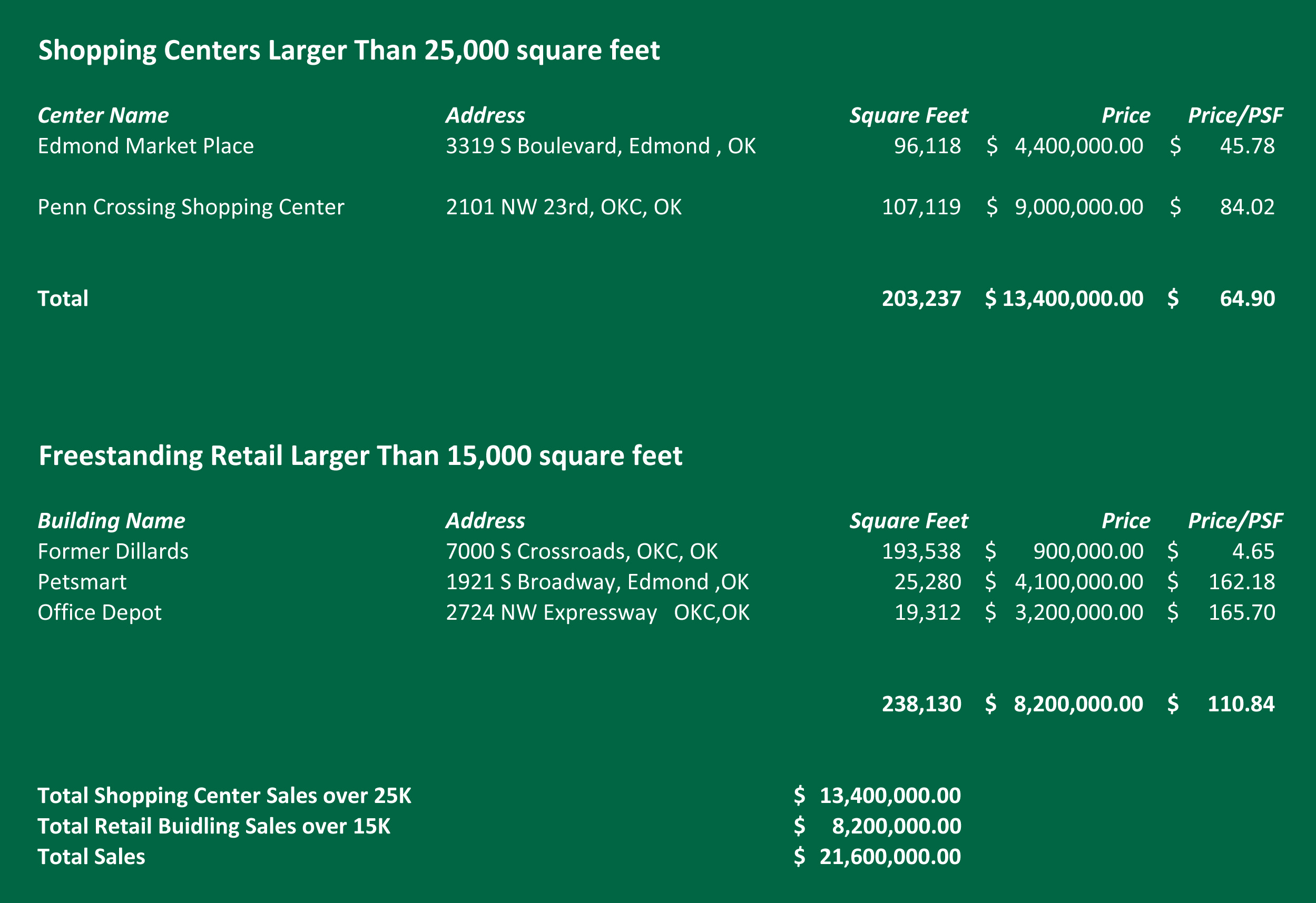

Retail Slow Start to Shopping Center Transactions The Oklahoma City metro saw only two shopping centers over 25,000 square feet change hands in the first quarter of 2013.

Edmond Market Place sold for $4,400,000 and was 93% vacant at the time of sale.

Penn Crossing was 90% occupied at the time of sale, sold for $9,000,000.

Both centers sold to local buyers.

Other areas of retail sales interest were three single tenant retails building.

The former Dillard's building at Crossroads Mall sold for $900,00 ($4.65 per square foot).

The mall ownership group purchased the building and have plans to incorporate it into the mall redevelopment.

Petsmart in Edmond and Office Depot located on Northwest Expressway both sold to out of state buyers.

Phillip Mazaheri, Retail Investment Specialist

Paul Ravencraft Retail Investment Specialist

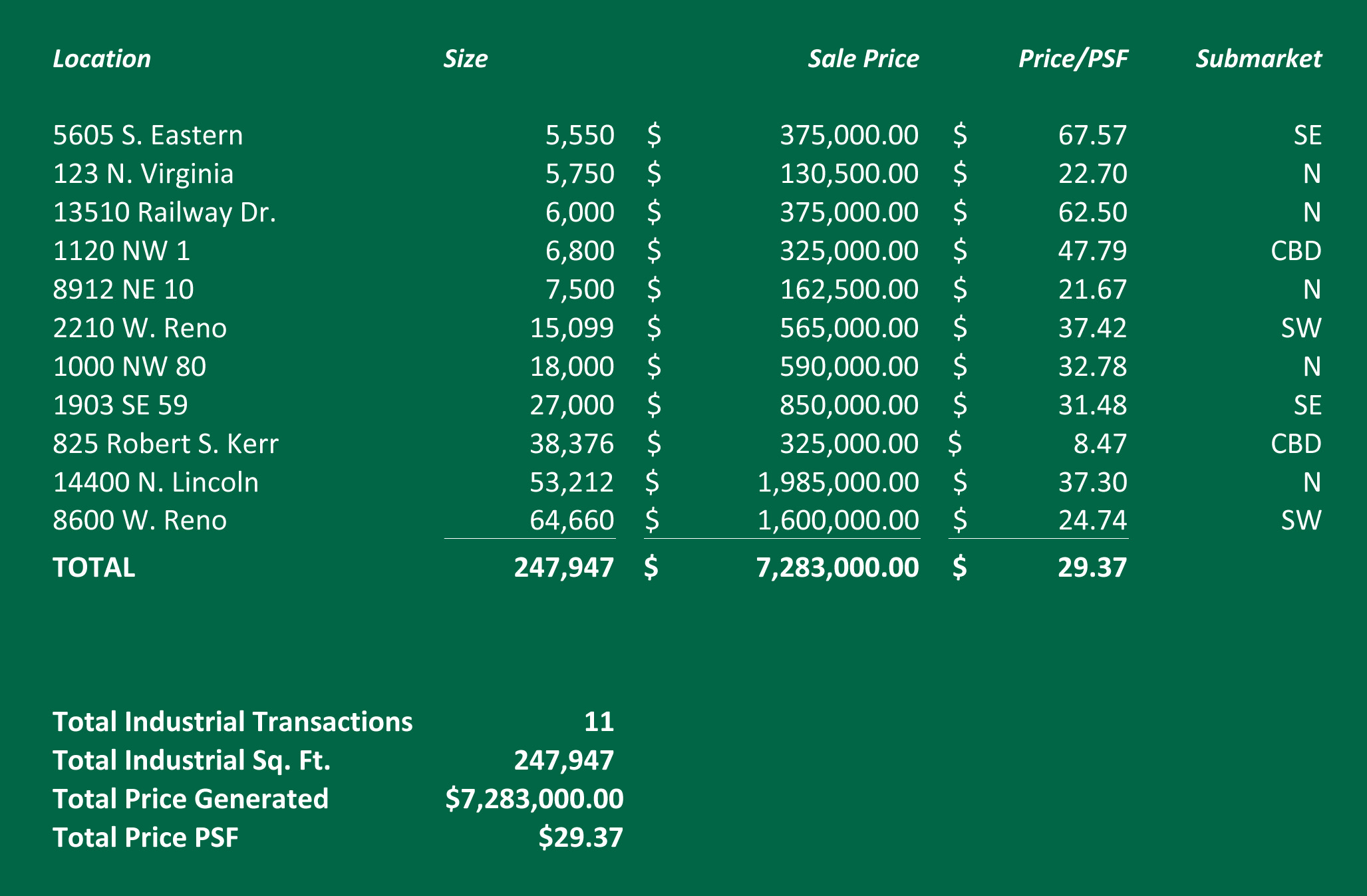

Industrial First Quarter of 2013 Yields Over $7,000,000 in Industrial SalesThe first quarter of 2013 saw 11 industrial transactions involving 247,000 square feet for $7.28 million, averaging $29.37 per square foot.

This contrasts with the first quarter of 2012 which recorded 20 sales totaling 291,000 square feet for $15.79 million, averaging $54.24 per square foot.

The difference between the two quarters is the nature of the properties involved.

The majority of the 2012 sales were buildings of less than 10,000 square feet, which cost more to build per square foot and command higher sales prices. 2013 sales were dominated by larger, older facilities with lower incremental values.

This comparison may reflect the scarcity or available property in our market with a 7.6% vacancy rate.

There was one sale of a multi-tenant property at 14400 N.

Lincoln.

This is a metal building originally constructed as an indoor soccer facility which has been converted to a multi-tenant service warehouse.

This building was fully leased at the time of the sale.

Bob Puckett

Industrial Specialist

Mark Patton

Industrial Specialist

Multifamily First Quarter of 2013 Surpasses Multifamily Transactions of Q1 2012 In the first quarter of 2013, Oklahoma City has experienced a total of nine multifamily transactions above 25 units, which is three more than in Q1 2012.

In Q1 of 2012 there were 819 units transacted, compared to 1,500 in 2013, an 83% increase.

The price per unit was down 54% to an average of $43,772 in 2013, mostly attributed to the quality of the assets sold, with only one Class A property trading compared to two in Q1 2012.

The following is a summary of price per unit by class for the first quarter of 2013: Class A - $130,000, Class B – $52,380, Class C - $19,064, Class D - $10,337.

Construction activity continues to be aggressive with approximately four new developments expected to be announced by the end of summer.

This keeps the construction activity above average levels with approximately 2,000 plus units per year expected to come online between the years 2014 and 2015.

Overall investors are optimistic that demand for multifamily housing will continue to increase, and lenders are remaining optimistic that new housing demand will lead the pack with market share and absorption.

Transaction activity for distressed assets has decreased but not due to lack of demand, rather because the majority of the distressed assets have been flushed through the system and are in the process of repositioning by the new ownership.

David Dirkschneider

Multifamily Specialist